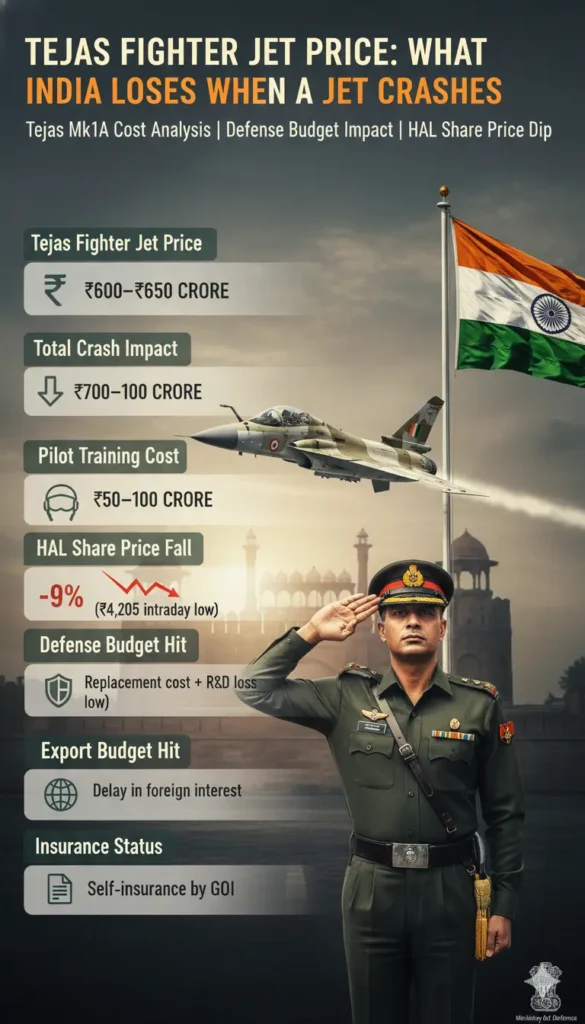

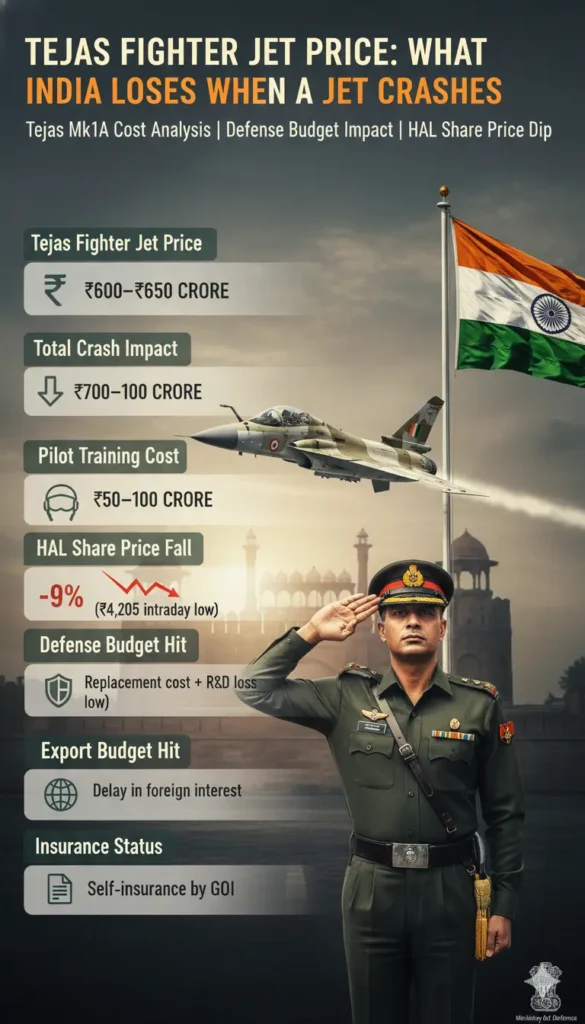

The Tejas fighter jet price became a major discussion after the Dubai Airshow 2025 crash that killed Wing Commander Namansh Syal. Beyond the emotional loss, the destruction of a ₹600+ crore aircraft raised key financial questions: What is the actual Tejas fighter jet price, and how much does India lose when one goes down? Is it insured, and who pays—HAL or the government? The crash also led to discussions about HAL’s share price decline, hidden research and development costs, and the true economic effects of each unit. When a high-value fighter jet crashes, the losses extend far beyond just manufacturing expenses—including sunk research, the value of pilot training, readiness gaps, and long-term strategic consequences.

1. The Direct Asset Loss: How Much Does a Tejas Fighter Jet Cost?

The most immediate financial effect is the loss of the aircraft itself.

Given that the Tejas Fighter Jet price amounts to hundreds of crores, the destruction of this 4.5-generation LCA—an outstanding accomplishment of India’s domestic engineering—incurs a substantial economic cost in addition to national pride.

The Replacement Cost

When you analyze the price of the Tejas fighter jet, the main figure to pay attention to is the current ‘fly-away’ cost: ₹600–₹650 crore for a Tejas Mk1A, not including weapon systems, radar upgrades, and electronic-warfare equipment. To put it simply, the ₹650 crore price of the Tejas fighter jet is about the same as the cost of building two metro flyovers or the annual income-tax contributions of nearly 60,000 middle-class Indians.

A common question is whether the Tejas is insured. The answer is no. Commercial insurance for active fighter jets is impractical due to the extremely high premiums. On the other hand, India practices a self-insurance technique, which means that any losses are directly written off from the defense budget.

As a result, money that could have funded drone purchases or squadron upgrades must now be diverted to replace the lost Tejas.

2. The Market Reaction: Why HAL Share Price Crashed

On November 24, 2025, the market reacted dramatically to the crash, with concerns about the Tejas Fighter Jet price causing panic selling.

HAL, which manufactures the jet, experienced a nearly 9% drop in its stock, reaching an intraday low of about ₹4,205.

This swift decline resulted in the loss of thousands of crores in market value in just a few hours.

What was behind the panic?

Concerns emerged among investors regarding the potential reputational damage due to the crash at the Dubai Airshow, an essential event for Tejas exports to nations such as Argentina, Egypt, and the Philippines.

Any uncertainty from foreign purchasers could have repercussions for HAL’s future orders.

Any doubts from international buyers might affect HAL’s upcoming orders.

In addition, delays from the Court of Inquiry might also have repercussions on production and revenue. Many long-term investors view the dip as a potential buying opportunity, assuming the investigation clears the aircraft of any technical faults.

Table of Contents

3. The Human Capital: The Cost of a Combat Pilot

Even though human life cannot be expressed in monetary terms, the crash related to the Tejas Fighter Jet price also points out the significant economic investment in training a pilot like Wing Commander Namansh Syal.

To become a combat-ready IAF pilot takes more than 10 years, countless flying hours on expensive trainers and fighters, and specialized training in survival skills, high-G maneuvers, and advanced simulators.

The financial worth of this training is estimated at ₹50–₹100 crore. Yet, more importantly, the IAF loses the unique experience and institutional knowledge that a pilot of Wg Cdr Syal’s level brings—something that no financial sum can replace.

4. The Hidden Costs: Investigation and Logistics

The financial hemorrhage continues beyond the crash site. The aftermath brings about significant operational expenses:

The Court of Inquiry (CoI): A high-ranking team is established to investigate. This entails logistics, forensic analysis of the ‘Black Box’ (Flight Data Recorder), and consultations with specialists.

Debris Recovery: The task of recovering the wreckage from a foreign airfield (Dubai) and transporting it back to India for analysis is a costly logistical operation.

Compensation: The government allocates a financial package (Liberalized Family Pension, gratuity, and insurance from the Air Force Group Insurance Society) to the next of kin, Wing Commander Afshan. While this is a state obligation, it constitutes a financial outflow.

5. Summary: The Total Bill for the Taxpayer

If we tally the tangible and intangible costs of the Tejas crash in Dubai:

| Cost Head | Estimated Value (₹) | Impact Type |

| Aircraft (Replacement) | ₹600 – ₹650 Cr | Direct Capital Loss |

| Pilot Training (Investment) | ₹50 – ₹100 Cr | Human Capital Loss |

| Crash Investigation & Logistics | ₹5 – ₹10 Cr | Operational Cost |

| HAL Market Cap Loss | Thousands of Crores | Shareholder Wealth |

| Potential Export Loss | Unknown (High) | Future Opportunity Cost |

| TOTAL DIRECT IMPACT | ~₹750 Crore | Immediate Liability |

FAQs About Tejas Fighter Jet Price

1. Is the Tejas fighter jet insured by insurance companies?

No. The policy of “self-insurance” is followed by the Indian government for military aircraft. The funds required to replace the jet are taken directly from the defense budget or taxpayer contributions, not from an insurance claim.

2. How does the Tejas crash affect HAL’s share price?

The crash induced a negative sentiment shock, causing HAL shares to decrease by almost 9% on November 24, 2025. Investors fear that this could negatively impact India’s ability to export the Tejas to other nations, thus affecting HAL’s future profit margins.

3. What happens to the family of the deceased pilot?

The family of Wing Commander Namansh Syal is set to receive a liberalized family pension equivalent to the officer’s final salary, a considerable sum from the Air Force Group Insurance Society (AFGIS), and other legally mandated gratuity benefits.

4. Will this crash stop the production of Tejas Mk1A?

Unlikely. There may be a momentary pause for safety checks, but the Tejas is vital to the IAF’s future. The government has already authorized orders for over 97 Mk1A jets, and production will continue once the cause (technical or human error) is determined. 19

Conclusion

The Tejas incident and the loss of Wing Commander Namansh Syal signify a grave moment for Indian aviation.

From a financial standpoint, this event emphasizes the heft of the Tejas fighter jet price—₹700–₹750+ crore with equipment—rendering each loss a significant impact on the national budget. Yet, defense economics is not solely about figures; it involves operational resilience. Traditionally, HAL and other defense stocks recover after investigations are finalized and production is stabilized. For taxpayers, this tragedy serves as a poignant reminder that the actual cost associated with the Tejas fighter jet is not merely financial—it is shouldered by the pilots who navigate these machines at their limits.

Rest in peace, Wing Commander Syal.