Managing finances in India has become increasingly challenging, yet wealth accumulation relies on a straightforward and disciplined approach to personal finance and international financial management—rather than merely a high income.

This guide provides a clear explanation of budgeting, tax strategies, credit score fundamentals, investment options, and salary structures, tailored for students, employees, freelancers, and NRIs.

Implement the 50-30-20 rule, create an emergency fund that lasts 3 to 6 months, automate your savings, and begin early SIPs. These practices enhance both personal and international financial management.

As India transitions to digital and global investing—and with many F&O traders incurring losses—the significance of disciplined planning is more crucial than ever.

This guide helps you evolve from a passive saver into a savvy wealth builder.

What is Personal Finance?

Personal finance refers to the prudent management of your finances — earning → saving → spending → investing → safeguarding your money.

It encompasses five key aspects of personal finance:

- Income management

- Budgeting and expenditure

- Saving and emergency preparedness

- Investing and wealth generation

Why Personal Finance Is Important in India

Effective personal finance management is vital in India, as it aids in combating increasing inflation, alleviating debt and EMI burdens, and gradually accumulating long-term wealth.

Additionally, it facilitates more strategic tax planning, safeguards your family in times of crisis, and guarantees a secure retirement.

These advantages resonate with the fundamental tenets of global financial management, where disciplined control over finances is crucial for achieving financial independence in a rapidly evolving economy.

Table of Contents

The 5 Core Areas of Personal Finance

The five key pillars of personal finance that are accepted globally align perfectly with the financial management practices of Indians. Together, they create a solid foundation for financial stability.

1. Income

Your income is the essential starting point for everything—including salary, freelance work, rental income, business profits, commissions, or side hustles. Understanding the differences between gross income, CTC, and in-hand income allows for more strategic planning.

2. Spending

Controlling your spending effectively shields you from lifestyle inflation. It ensures a healthy balance between needs and wants, keeps EMI pressures under control, and prevents your increasing income from resulting in higher expenses.

3. Saving

Savings create liquidity and provide immediate financial safety. This includes keeping money aside for emergencies, short-term goals, or upcoming expenses. Smart saving habits prevent unnecessary borrowing.

4. Investing

By investing, your money can expand at a rate that exceeds inflation.Through avenues like mutual funds, index funds, PPF, stocks, SGBs, NPS, or REITs, investing nurtures long-term wealth and moves you from a survival mindset to one of financial independence.

5.Protection

This serves as your safety net—a combination of insurance and emergency funds. Health and term insurance shield your family from financial setbacks, while your emergency fund guarantees stability during job loss or health crises.

These five pillars collaborate as a singular system.

If just one pillar is deficient—income, spending, saving, investing, or protection—the whole financial foundation becomes precarious. Strengthening all five is vital for ensuring long-term security and wealth.

Budgeting Rules for Indian Households

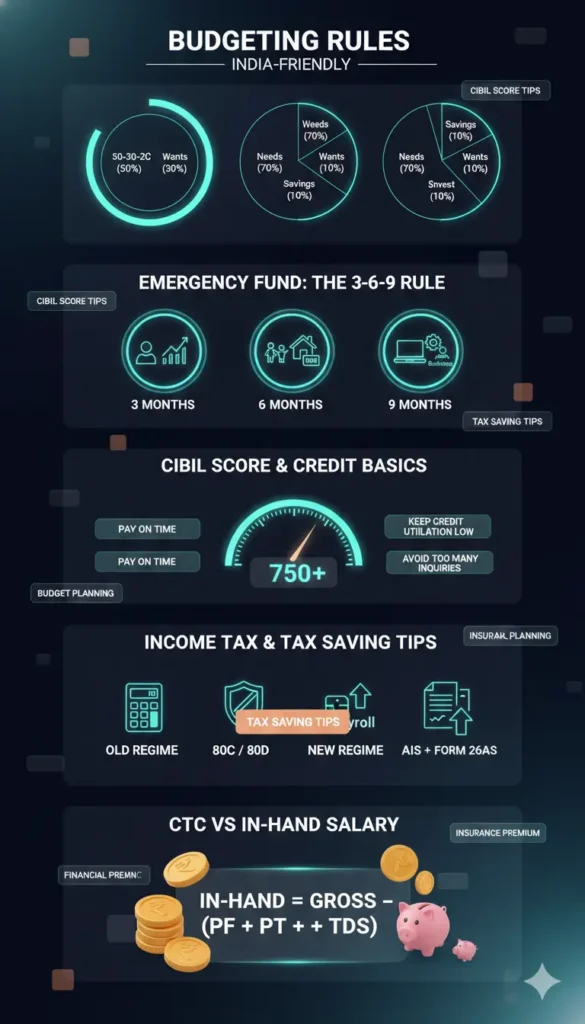

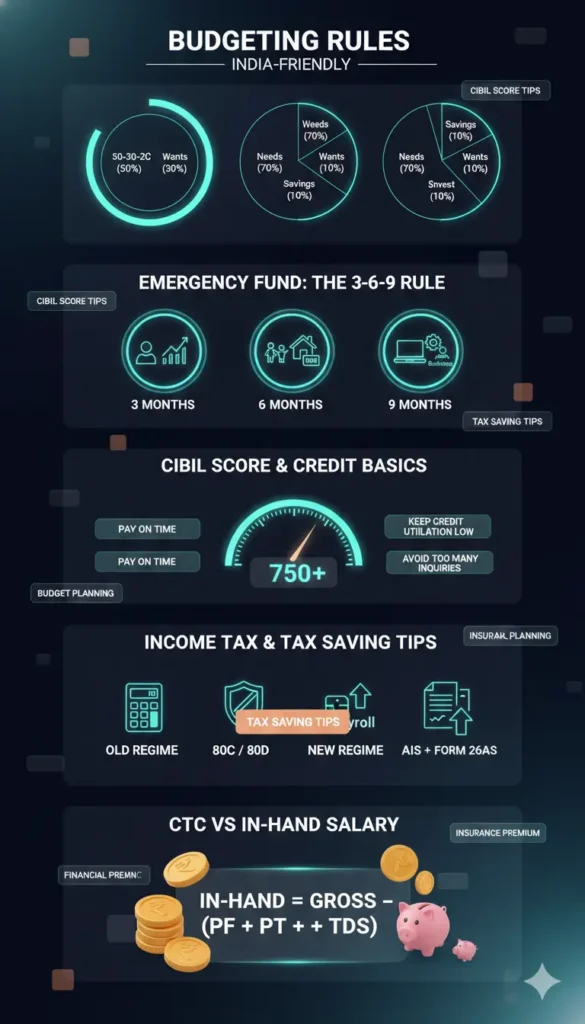

The 50-30-20 Budgeting Rule for Personal Finance

The 50-30-20 rule allocates your income into 50% for needs, 30% for wants, and 20% for savings or investments, providing a straightforward framework for Indian earners.

However, in metropolitan areas where rent and EMIs are elevated, variations that cater to Indian circumstances are more effective—such as the 70/20/10 rule, the 70-10-10-10 division (which distinguishes saving from investing), and the 60/20/20 rule designed for families with fixed financial commitments.

To facilitate easier tracking, consider using budgeting applications like Walnut, Jupiter, Fi, and Moneyfy, along with UPI-based expense tracking for real-time management.

The 70-20-10-10 Budgeting Rule for Personal Finance

70% Living Expenses • 20% Savings • 10% Debt/Charity

This guideline aligns well with the realities in India, where necessities such as rent, groceries, transportation, education, and EMIs consume a significant portion of income.

Ideal for:

- Urban dwellers

- Individuals facing high rental or commuting expenses

- Newcomers seeking an uncomplicated and flexible budgeting framework

It guarantees that you consistently save 20%, while the 10% designated for debt repayment or charitable contributions resonates with Indian cultural values and familial obligations.

The 70-10-10-10 Framework for Personal Finance

70% Living • 10% Saving • 10% Investing • 10% Giving/Debt

This approach differentiates saving from investing, which is a frequent error made by many Indians who confuse the two.

Savings = liquidity (emergency fund, short-term aims)

Investing = growth (SIPs, stocks, NPS, SGBs)

This principle ensures that you are continually enhancing both safety (savings) and wealth (investments), while also setting aside some funds for giving or paying off debts.

The 40-40-20 Personal Finance Strategy

40% Taxes + Expenses • 40% Investments • 20% Lifestyle

This ambitious strategy is suited for high-income individuals and those involved in the FIRE movement (Financial Independence, Retire Early).

- Demands stringent control over lifestyle expenditures

- Prioritizes wealth building by investing nearly 50% of income

- It is most beneficial when your income can comfortably support a 20% lifestyle fund.

- Ideal for those pursuing early retirement or rapid financial growth.

Basics Of Emergency Fund: The 3–6–9 Rule

An emergency fund serves as your financial safety net in cases of job loss, health issues, or unexpected expenses.

The simplest method to determine its size is the 3–6–9 Rule, which adjusts the fund amount based on how stable your income is and how many individuals rely on you.

This guideline ensures you are neither underprepared nor saving excessively, making it suitable for Indian earners with various lifestyles.

How much you should save:

- 3 Months: Stable job, single, low responsibilities

- 6 Months: Married, kids, EMIs, moderate family needs

- 9–12 Months: Freelancers, business owners, volatile income

Where to keep it:

- Sweep-in FDs

- Liquid mutual funds

- Ultra short-term debt funds

Where to Keep Your Emergency Fund?

Your investment should remain both liquid and secure. The most suitable choices are:

- Sweep-in fixed deposits (FD returns with immediate access)

- Liquid mutual funds (fast redemption)

- Ultra short-term debt funds (minimal volatility, consistent returns)

CTC vs In-Hand Salary: What Reduces Your Take-Home Pay

A ₹1 lakh salary falling to nearly ₹83,874 in hand is common once you understand the workings of CTC. CTC includes several non-cash benefits like employer PF, gratuity, and insurance, which lower your take-home amount but add value in the long run. Your in-hand salary is calculated by deducting employee PF, professional tax, and income tax from your gross salary. Hence, an individual with a ₹12 lakh CTC, like Arjun, ultimately takes home only about ₹83,874 per month—because a large portion of the package is not disbursed as cash.

Understanding Taxation in India

Tax planning is straightforward once you understand the fundamentals of both tax regimes and the essential documents required. The New Regime features simpler tax slabs and lower rates, while the Old Regime is preferable if you utilize several deductions like HRA, 80C, 80D, or home loan interest. Keep in mind the straightforward breakeven rule: if your total deductions are over ₹4.25 lakh, the Old Regime might save you more on taxes; if not, the New Regime is generally better for maximizing your in-hand salary.

- Form 26AS: Shows all TDS deducted on your behalf

- AIS: Shows every financial activity, such as interest, dividends, investments, and high-value transactions

- TIS: A simplified summary of the AIS

In case your ITR does not correspond with the information in the AIS, you could receive a notice—therefore, always examine these documents prior to filing.

TDS Refund Process: Simple and Clear Steps

- Assess your real tax responsibility.

- Ensure that all TDS is properly shown in Form 26AS.

- File your Income Tax Return (ITR).

- E-verify without delay.

Your refund will be credited to your bank account following processing.

Building a robust personal finance system requires time—it stems from small, steady actions.Whether you’re budgeting effectively, setting up an emergency fund, investing consistently, or handling your taxes properly, every action contributes to your financial well-being. Start now, remain committed, and your money will begin to work in your favor.

Saving & Investment Basics in Financial Management

These key principles serve as the cornerstone for achieving long-lasting wealth in personal finance, supporting beginners in making a solid start and leading advanced investors to make more intelligent choices.

Small Savings Schemes (Government-Backed Options)

Safe, stable, and perfect for conservative or long-term objectives. Current rates (Jan–Mar 2025):

- PPF – 7.1%

- Sukanya Samriddhi Yojana (SSY) – 8.2%

- Senior Citizen Savings Scheme (SCSS) – 8.2%

- National Savings Certificate (NSC) – 7.7%

These options provide security, safeguard against inflation, and ensure predictable returns, making them excellent for a well-rounded personal finance plan.

The Rule of 72: A Simple Money-Doubling Formula

A straightforward mental model to grasp the speed at which your money increases.

Money doubles = 72 ÷ interest rate

For instance:

A 12% equity mutual fund approximately doubles your investment in 6 years.

Mutual Fund Basics

Mutual funds are among the most straightforward and powerful tools for generating long-term wealth in personal finance.

- SIPs help cultivate discipline by ensuring consistent monthly investments.

- Rupee-cost averaging reduces the effects of market volatility.

- Over time, equity mutual funds contribute to the creation of sustainable, long-term wealth.

They are suitable for both new and experienced investors aiming for future goals.

The 25X Rule for Retirement Planning

A straightforward and trustworthy formula for figuring out your retirement corpus: Required Retirement Corpus = 25 × Annual Expenses

For instance: If your annual expenses are ₹12 lakh, you will need around ₹3 crore to retire comfortably. This guideline ensures that you can withdraw approximately 4% each year and still keep your lifestyle intact without depleting your resources.

Credit Score Basics & The 5 Cs Lenders Use

Indian lenders assess every borrower through the lens of the 5 Cs of Credit, which are essential in determining loan approval, interest rates, and credit limits.

- Character: This pertains to your credit history and CIBIL score (strive for a score of 750 or above).

- Capacity: This assesses your ability to repay the loan (ensure that EMIs do not exceed 40% of your income).

- Capital: This is your own contribution, such as a down payment.

- Collateral: These are the assets you pledge against the loans (like your home, gold, or property).

- Conditions: These encompass economic factors, including interest rate trends and market conditions.

These five elements establish your creditworthiness and significantly impact all lending decisions.

Must-Have Insurance Essentials in India

Insurance defends your complete financial plan by taking care of medical expenses, income loss, accidents, cyber risks, and property damage.

Instead of just relying on health and life insurance, every Indian family should construct a comprehensive protection layer with the following vital policies:

Core Insurance You Must Have:

- Health Insurance: No limits on room rent, includes consumables coverage, and restoration benefits

- Term Life Insurance: Only pure term plans; coverage of 15–20 times your annual income

- Personal Accident Insurance: Covers accidental death and disability

- Critical Illness Insurance: Provides a lump-sum payout for serious illnesses

- Motor Insurance: Required for car and bike owners (prefer comprehensive with zero depreciation)

Retirement Planning: NPS, EPF & UPS

Unified Pension Scheme (UPS)

- Effective from April 2025

- Ensures that government employees receive 50% of their basic pay as pension.

National Pension System (NPS)

- Perfect for young investors willing to take on higher risks.

- Permits an equity allocation of up to 75%.

- Offers significant long-term compounding advantages.

Combining EPF and NPS establishes a robust foundation for retirement.

Best Money Habits in Your 20s

The earlier you take action, the more solid your financial foundation will be.

- Launch SIPs as soon as possible.

- Avoid increasing your lifestyle expenses.

- Keep your EMIs below 40% of your earnings.

- Develop an emergency fund.

- Invest before you make purchases.

Frequently Asked Questions About Personal Finance

Q1. What are the 5 pillars of personal finance?

The five core components of personal finance consist of income, spending, saving, investing, and protection. Income is the amount you earn; spending is the management of your expenses. Saving creates liquidity for emergencies, investing helps your money grow over time, and protection—through insurance and an emergency fund—provides financial security.

Q 2. What is the best budgeting rule in India?

The best budgeting approach in India is influenced by your geographical area. In metropolitan regions with high rental prices, the 70-20-10 rule is the most beneficial, as it provides more leeway for living expenses. In contrast, for Tier-2 and Tier-3 cities, the 50-30-20 rule is ideal, as it offers a balanced distribution of needs, wants, and savings.

Q3. How much emergency fund do I need?

It is essential that your emergency fund reflects your income stability: aim to save 3 months of expenses if you hold a stable job, 6 months if you have a family or are paying EMIs, and 9 to 12 months if your income is inconsistent, like that of freelancers or entrepreneurs.

Q4. Which is better: Old or New Tax Regime?

The optimal tax regime is determined by your deductions. If your total deductions and exemptions fall below ₹4.25 lakh, the New Tax Regime is generally more advantageous due to its lower tax rates. Conversely, if your deductions exceed ₹4.25 lakh, the Old Regime might provide greater tax savings.

Q5. What is a good credit score?

A credit score of 750 or more in India is considered good. This level of scoring increases your chances of loan approval, helps you obtain lower interest rates, and demonstrates to lenders that you are reliable in repaying loans.

- Freelancer Income in India: Taxes, Savings & Smart Money Tips

- Health Insurance Tax Benefits: Deductions, Eligibility & GST Relief

- How AI-Based Investment Apps Are Changing Wealth in India

- 5 Best Insurance Policy Plans in India: Types, Claims & Tax Benefits

- How to Build Credit as a Freelancer Without Income Proof

- Top 5 Benefits & Mistakes in Tax-Free Investment for Child

- 7 Ways to Choose the Best Travel Insurance for Your Trip

Conclusion

Your financial resources are much more effective when you bring together the essentials: insurance, an emergency fund, smart budgeting, effective tax planning, consistent investing, and a long-term mindset.

Financial freedom isn’t merely a figure; it’s the ability to live life free from money-related stress. The best time to start creating that freedom is right now.