There is no end to India’s enduring fascination with gold. No matter whether you are a student trying to save your first lakh or an entrepreneur trying to diversify your portfolio, having a solid grasp of the gold price, including the current gold price per gram as well as variances based on city, will enable you to make more informed purchases. In this book, we dissect the most recent prices for 22-carat and 24-carat gold in many cities, including Delhi, Kolkata, Jaipur, Ahmedabad, and Lucknow. We also investigate the factors that influence these prices and discuss investing techniques that are suitable for novices and are adapted to the Indian environment.

Gold is used in various contexts, including weddings, festivities, and financial planning, in addition to its value as a metal. Both individuals in business and those participating in gift-giving use the current price of gold as a benchmark. By providing you with straightforward explanations, examples from the real world, and information that is particular to your location, this article intends to simplify everything to assist you in saving and investing with confidence. It is necessary to be aware of the cost of one gram of gold and to maintain a record of the current price of gold at 22 carats to complete this procedure.

Understanding Gold Price Basics

What Determines the Gold Price?

- Prices are established twice daily in London’s bullion market in US dollars, and then they are translated to Indian rupees on a daily basis.

- When it comes to production and import costs, you’ve got mining expenses and a customs duty of 10%, along with a processing GST of 3%. All of these factors play a role in determining the landed price in India.

- Changes in the value of the rupee cause imports to become more expensive, which in turn drives up the price of gold on the local market.

Why 22-Carat vs. 24-Carat Matters

- 24K is 99.9% pure, whereas 22K, which costs ₹8,720 per gram, is a combination of gold and copper/zinc for increased strength.

- When it comes to jewellery, 22K is the go-to choice because it’s more durable. On the other hand, if you’re looking at bars, coins, or digital gold, 24K is the way to go.

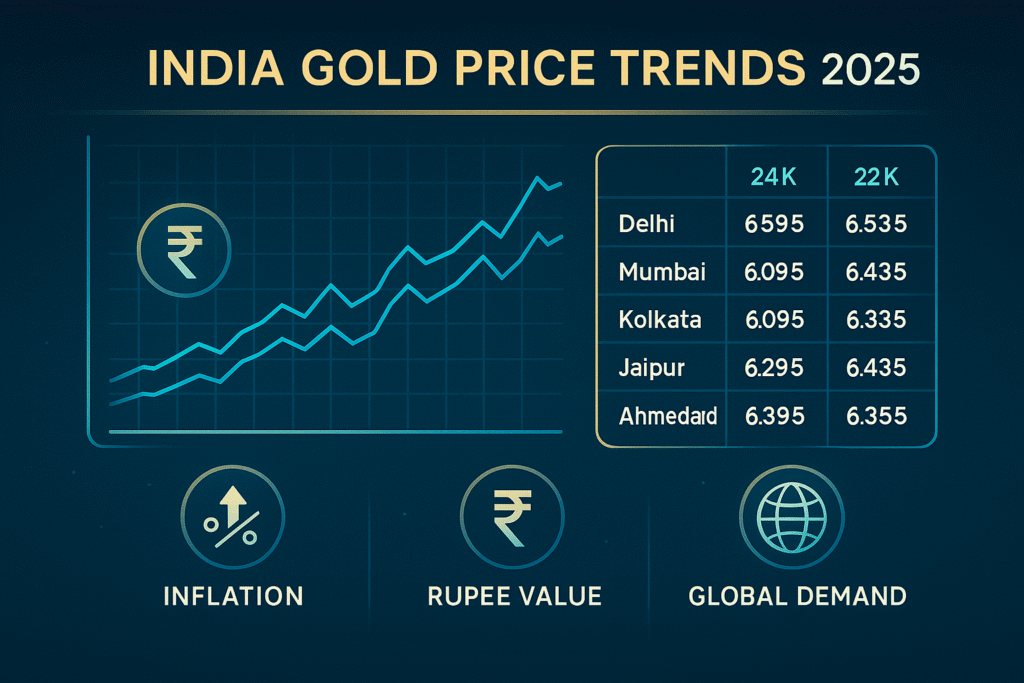

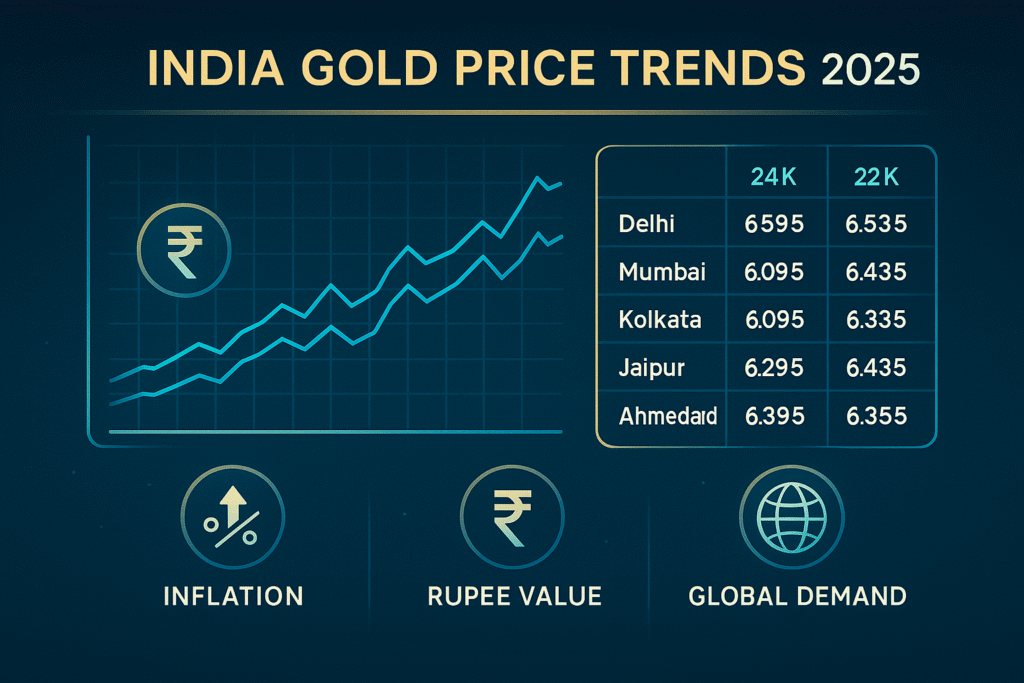

Today’s Gold Price Across Major Indian Cities

| City | 22-Carat (₹/g) | 24-Carat (₹/g) |

| Delhi | ₹7,225 | ₹7,698 |

| Kolkata | ₹7,140 | ₹7,617 |

| Jaipur | ₹7,134 | ₹7,597 |

| Ahmedabad | ₹7,085 | ₹7,546 |

| Lucknow | ₹6,962 | ₹7,562 |

| Indore | ₹7,120 | ₹7,590 |

| Bhopal | ₹7,110 | ₹7,580 |

| Gwalior | ₹7,100 | ₹7,570 |

| Mumbai | ₹7,300 | ₹7,770 |

| Hyderabad | ₹7,150 | ₹7,620 |

| Bangalore | ₹7,280 | ₹7,750 |

| Chennai | ₹7,260 | ₹7,720 |

Please Note that the prices shown here are just indicative and may change somewhat from one supplier to another. Price of Gold

Table of Contents

Why Should You Care About Gold Prices

Understanding the price of gold is not something that is exclusive to jewelers or merchants. The following is why it is important to you:

- Are you considering investing in gold? It’s advisable to monitor the current price to ensure you make your purchase at the optimal time.

- Planning to purchase gold jewelry, budgeting for purchases? Knowing pricing patterns can help you create a sensible budget.

- Thinking about diversifying your assets? Gold might be a solid choice to consider for your investment portfolio, particularly when the economy feels a bit shaky.

An Overview of Gold Demand in India

India really loves its gold! In 2023, the country produced only 15.1 tons, but the demand skyrocketed to 747 tons—talk about a huge gap between what’s made and what’s wanted! This highlights how important gold is both culturally and financially, which makes it really important for investors and savers to stay updated on market insights.

Tips for First-Time Gold Investors

- Get familiar with the different levels of purity: 22K gold is often used for jewelry, but 24K gold is purer and is frequently used for investment reasons.

- Ensure that the gold you buy is hallmarked by the Bureau of Indian Standards (BIS), which is a sign that it is genuine and pure.

- To ensure that you are always up to date, it is important to regularly check gold prices via reputable sources.

- You should think about investing in digital gold since there are now platforms that enable you to do so, providing you with freedom and security.

- To reduce the impact of volatility, use systematic investment plans (SIPs) in gold exchange-traded funds (ETFs).

Gold as a Long-Term Investment

Historically, gold has shown fortitude in recessionary times. For example, when investors looked for safety during the 2008 financial crisis, gold prices skyrocketed. In the same vein, global uncertainty recently has spurred higher gold investments. Gold is still a powerful tool for long-term wealth preservation even if previous success does not ensure future outcomes.

Benefits of Adding Gold to Your Portfolio

- Protects against inflation by maintaining its worth even while the value of the currency decreases.

- There is a little link between diversification and real estate and equity investments.

- The emotional comfort that gold brings comes from its cultural resonance, which offers psychological confidence in times of uncertainty.

Frequently Asked Questions (FAQs)

What is the gold rate today?

On May 30, 2025, the gold prices in India are ₹9,731 per gram for 24K gold and ₹8,920 per gram for 22K gold. You’ll notice that prices can change a bit from one city to another.

Will gold rate decrease in coming days?

Especially in wedding or holiday seasons, this is a typical query. Should world inflation fall, the rupee gain strength, or interest rates increase, the gold rate may decline in the next days. Unexpected occurrences like financial crises or wars, nevertheless, may raise costs. Invest little amounts consistently using SIPs or digital gold to help you avoid timing the market.

Why gold rate is increasing these days?

High inflation, a weak rupee, global uncertainty, and central banks’ increasing purchases are driving gold prices higher. These elements increase demand, so gold becomes a safer and more appealing investment choice.

How to calculate gold rate in India?

Multiply the international gold price by the USD-INR rate, then add import duty (10%), GST (3%), and dealer margin. This formula gives you the approximate retail gold price per gram in India.

What is white gold?

White gold is an alloy created by mixing pure gold with white metals such as nickel, silver, or palladium. It has this cool silvery-white appearance and is commonly found in modern jewelry. It usually has 75% gold, which is 18-carat. It might resemble platinum, but it’s easier on the wallet, though you might have to get it replated eventually.

How to invest in gold in India?

There are a bunch of ways to make investments in gold. You can go for the traditional options like jewelry as well as coins or try out digital gold through UPI apps. If you’re into stocks, gold ETFs (exchange-traded funds) are available using demat accounts, and you can also consider sovereign gold bonds. SIPs help you build wealth over time without stressing about market timing, starting with just a small investment.

Conclusion

Gold in India holds historical significance, serving not only as a valuable metal but also as a symbol of wealth, safety, and tradition. By keeping yourself updated on the latest pricing with market trends, you can enhance your financial decision-making abilities.

This advice applies equally to investing for the foreseeable future and purchasing jewelry. Are you ready to take charge of your finances? One effective approach is to consistently track gold prices. It is important to evaluate how gold aligns with your comprehensive investment approach.